In the fast-evolving digital economy, businesses across the world rely on payment processors to handle financial transactions. However, not all businesses are created equal in the eyes of financial institutions, especially when it comes to processing payments. Some businesses, known as high-risk merchants, face unique challenges in securing reliable and affordable payment processing services. Traditional Payment Processors Avoid High-Risk Merchants due to the elevated risk factors associated with fraud, chargebacks, and regulatory issues. High-risk payment processing refers to the specialized services designed to cater to businesses that operate in industries with a higher potential for fraud, chargebacks, and regulatory scrutiny. In 2025, high-risk payment processing is becoming more critical than ever, with many businesses in CBD, e-commerce, adult entertainment, and financial services finding themselves in need of specialized solutions.

In this article, we will dive deep into the concept of high-risk payment processing, the industries most affected, and how businesses can secure the right solutions to thrive despite the challenges.

What is High-Risk Payment Processing?

High-risk payment processing refers to the practice of using payment processors and merchant accounts specifically designed for businesses that are classified as “high-risk” by traditional financial institutions. These businesses often face higher rates of chargebacks, fraud, and regulatory concerns, which makes them more challenging to serve for traditional banks and payment processors.

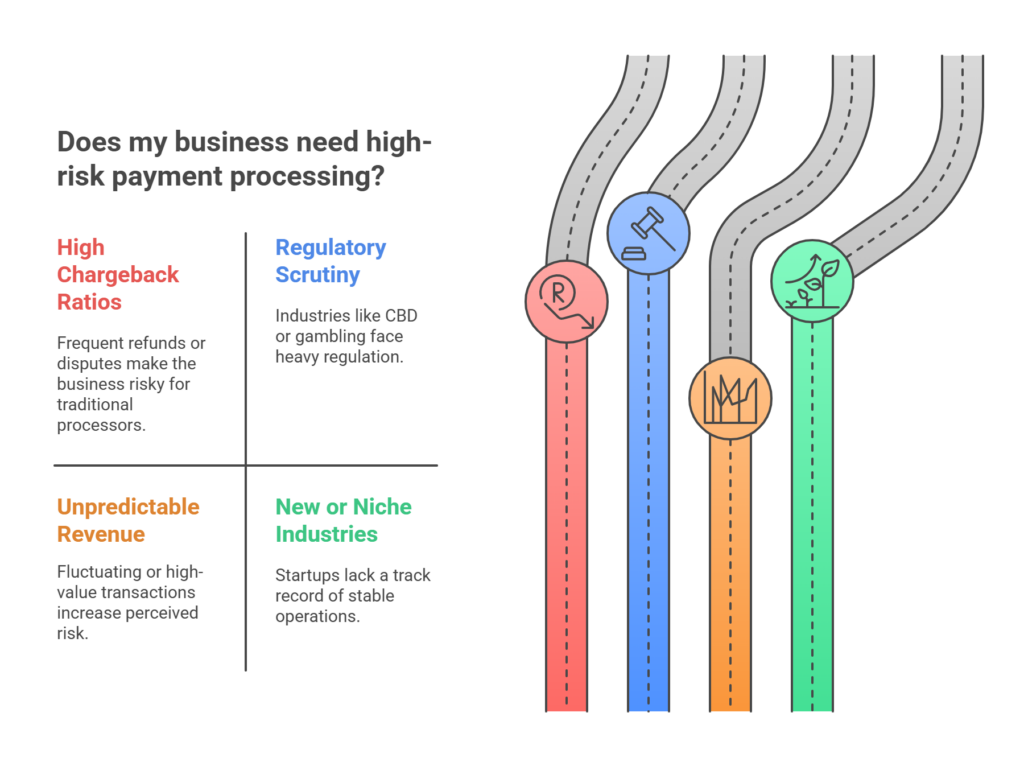

High-risk businesses typically fall into the following categories:

- High chargeback ratios: Businesses with frequent refunds or disputes are considered risky for payment processors.

- Regulatory scrutiny: Industries that are heavily regulated by government bodies, such as CBD, gambling, and firearms.

- Unpredictable revenue: Companies with fluctuating or high-value transactions can be seen as higher-risk.

- New or niche industries: Startups or emerging sectors may lack a track record of stable operations, which increases perceived risk.

To mitigate these risks, high-risk businesses require specialized processing solutions that offer additional fraud protection, chargeback mitigation, and regulatory compliance.

Industries Most Affected by High-Risk Payment Processing

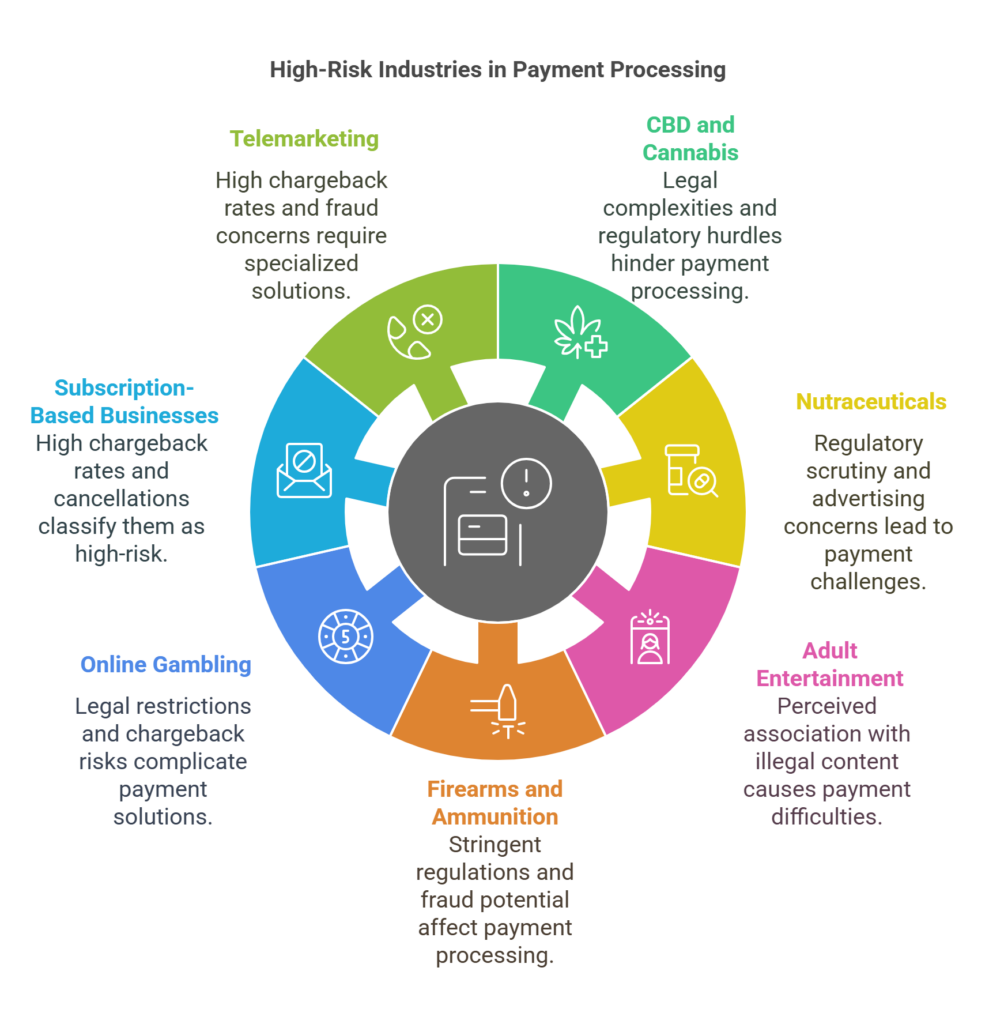

Certain industries are more likely to encounter high-risk payment processing situations due to the nature of their business models. These industries often have higher chargeback rates, stringent regulations, or a greater likelihood of fraudulent transactions. Here are some of the key sectors that are most affected:

- CBD and Cannabis Industry

The legalization of cannabis across various states in the U.S. has given rise to a booming industry, but CBD and cannabis businesses still face significant challenges when it comes to payment processing. Traditional payment processors tend to avoid cannabis-related transactions due to legal complexities and ongoing regulatory hurdles. - Nutraceuticals and Dietary Supplements

Health products, especially dietary supplements, are frequently subject to regulatory scrutiny. Many traditional processors avoid these businesses due to concerns over false advertising claims or the risk of chargebacks due to customer dissatisfaction. - Adult Entertainment

The adult entertainment industry is often considered high-risk due to its nature and perceived association with illegal or inappropriate content. As a result, businesses in this sector often face difficulty securing reliable payment processing solutions. - Firearms and Ammunition Sales

Merchants in the firearms and ammunition industry also face challenges in payment processing due to stringent regulations and the potential for fraud. - Online Gambling and Gaming

While online gambling is legal in many parts of the world, it remains highly regulated. Payment processors are cautious when handling transactions related to online gambling due to legal restrictions, chargeback risks, and potential fraud. - Subscription-Based Businesses

Subscription models, such as SaaS (Software as a Service) platforms, digital goods, or subscription box services, often encounter higher rates of chargebacks and cancellations, classifying them as high-risk businesses. - Telemarketing and Lead Generation

Telemarketers and lead generation companies face significant challenges due to high chargeback rates and fraud concerns. These industries often require specialized payment solutions to ensure smooth transactions.

Why Traditional Payment Processors Avoid High-Risk Merchants

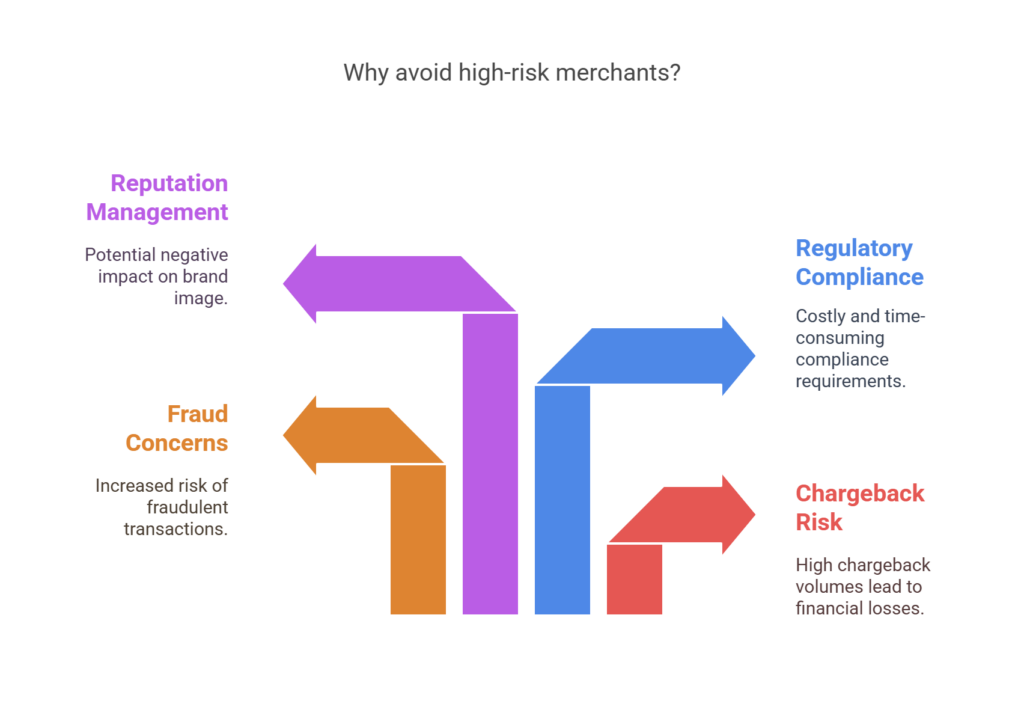

Traditional payment processors, such as Visa, MasterCard, PayPal, and Stripe, often avoid high-risk businesses due to several critical factors:

- Chargeback Risk

High-risk businesses often deal with a significant volume of chargebacks—disputed transactions that lead to financial losses for payment processors. These chargebacks can occur due to customer dissatisfaction, fraud, or misunderstandings, and when they are frequent, they pose a substantial risk to payment processors. - Fraud Concerns

Some high-risk industries, like adult entertainment and online gambling, are prone to fraudulent activity. Processing payments for businesses in these sectors exposes processors to a higher risk of fraudulent transactions, which can lead to financial losses, legal liabilities, and brand damage. - Regulatory Compliance

Many high-risk industries operate in heavily regulated environments. For instance, CBD businesses must comply with a patchwork of state and federal laws, while gambling businesses are subject to licensing and legal frameworks that vary across jurisdictions. Compliance with these regulations is time-consuming and costly for payment processors, making them reluctant to work with such businesses. - Reputation Management

Large, well-established payment processors are often concerned with their brand reputation. Associating with businesses that operate in controversial or high-risk sectors may lead to negative press, customer complaints, or even legal challenges.

The Role of High-Risk Payment Processors

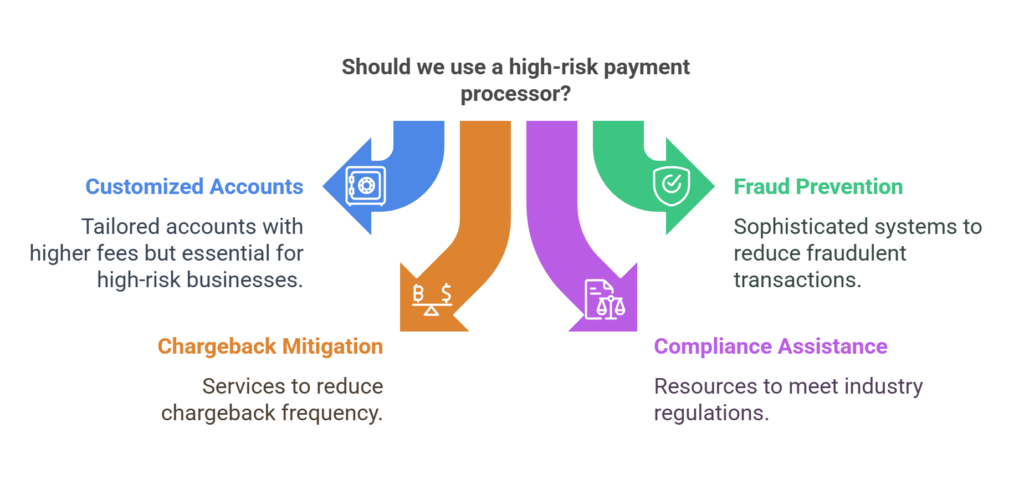

Unlike traditional payment processors, high-risk payment processors specialize in offering payment solutions tailored to businesses in these challenging industries. These specialized processors provide several benefits to high-risk merchants:

- Customized Merchant Accounts

High-risk payment processors offer merchant accounts that are specifically designed to handle the unique risks associated with high-risk businesses. These accounts may come with higher fees but are essential for businesses that cannot obtain a standard merchant account. - Fraud Prevention Tools

High-risk processors often employ sophisticated fraud prevention systems to reduce the risk of fraudulent transactions. These systems may include real-time transaction monitoring, AI-driven fraud detection, and chargeback management. - Chargeback Mitigation Services

Many high-risk payment processors provide chargeback mitigation services to help businesses reduce the frequency of chargebacks. This might involve dispute management tools, advanced reporting, and customer service improvements. - Compliance Assistance

Payment processors like Cathedral Payments help businesses stay compliant with industry regulations by providing resources and tools to ensure that transactions meet the legal requirements of their industry.

How High-Risk Payment Processing Works

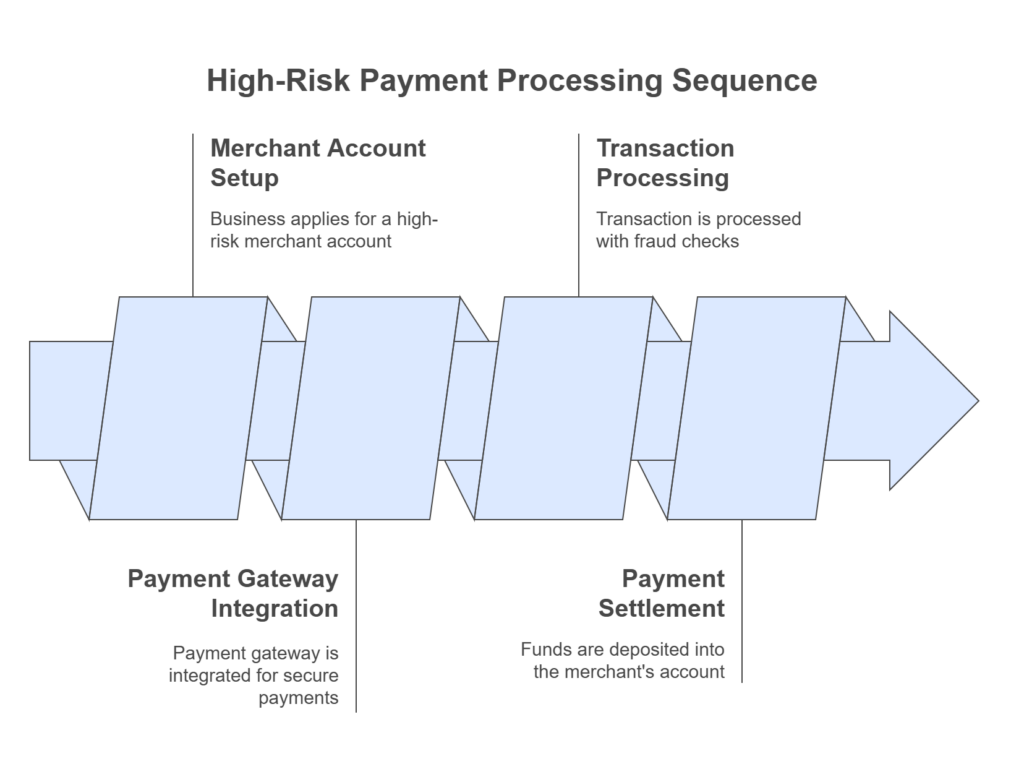

The high-risk payment processing system follows a similar structure to traditional payment processing but with additional layers of fraud protection, chargeback management, and compliance. Here’s how it typically works:

- Merchant Account Setup

A business applies for a high-risk merchant account through a specialized payment processor. The processor reviews the business’s history, industry type, and risk factors before approving the account. If approved, the business can begin processing payments. - Payment Gateway Integration

A payment gateway is integrated into the business’s website or point-of-sale system to facilitate secure payments. The gateway encrypts the transaction details, ensuring that sensitive information is transmitted securely. - Transaction Processing

When a customer makes a purchase, the transaction is routed through the payment processor, which verifies the payment details, checks for fraud, and ensures that the transaction meets compliance standards. - Payment Settlement

Once the transaction is approved, the funds are deposited into the merchant’s account, minus any processing fees. High-risk merchants may face higher fees compared to low-risk businesses, but the payment processor helps mitigate the risks associated with the transactions.

Benefits of High-Risk Payment Processing

High-risk payment processing offers several key advantages for businesses operating in high-risk industries:

- Reduced Chargebacks

Through specialized chargeback prevention and mitigation services, businesses can reduce the frequency of chargebacks, which ultimately helps protect their bottom line. - Compliance Assurance

Working with a high-risk payment processor ensures that businesses remain compliant with industry-specific regulations, reducing the risk of penalties or legal issues. - Enhanced Security

High-risk payment processors employ advanced security features, such as tokenization, 2FA (two-factor authentication), and secure payment gateways, to protect against fraud and data breaches. - Dedicated Support

Many high-risk processors offer personalized customer service to assist businesses in managing their accounts, navigating chargeback issues, and optimizing their payment processes.

Challenges and Risks for High-Risk Merchants

While high-risk payment processing offers many benefits, businesses must also be aware of the challenges:

- Higher Fees

High-risk payment processors typically charge higher fees than traditional processors. These fees cover the added risk associated with processing transactions for businesses in high-risk sectors. - Stricter Approval Requirements

The approval process for high-risk merchant accounts can be more stringent, with businesses needing to provide additional documentation and demonstrate financial stability. - Limited Payment Options

Some high-risk processors may restrict the types of payments they allow, limiting options for customers and potentially reducing sales.

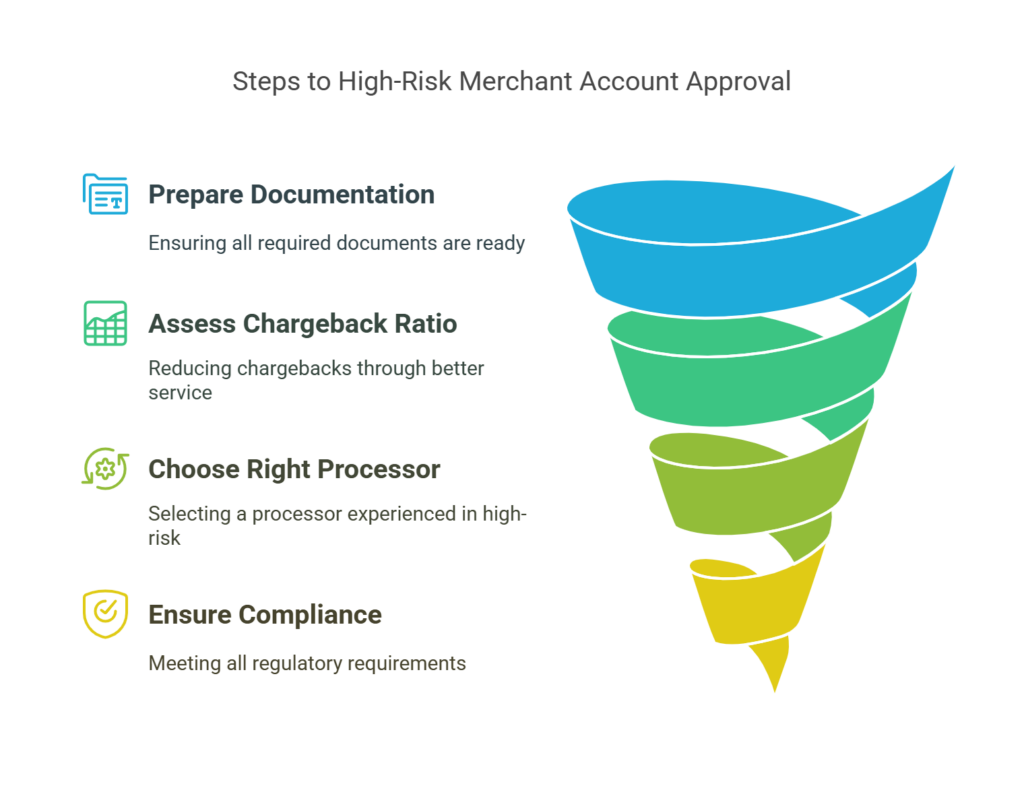

How to Get Approved for a High-Risk Merchant Account

To successfully obtain approval for a high-risk merchant account, businesses must follow specific steps:

- Prepare Documentation

Provide financial statements, business plans, tax returns, and other documents to demonstrate the financial stability and legitimacy of your business. - Assess Chargeback Ratio

Minimize your chargeback ratio by improving customer service, offering clear product descriptions, and using fraud prevention tools. - Choose the Right Processor

Work with a payment processor that specializes in your industry and has experience dealing with high-risk businesses. - Ensure Compliance

Ensure that your business complies with all relevant regulations and that your payment processor offers compliance support.

Conclusion

High-risk payment processing is essential for businesses in industries with a higher likelihood of chargebacks, fraud, and regulatory scrutiny. In 2025, specialized processors like Cathedral Payments are playing a crucial role in helping high-risk merchants navigate the challenges of secure payment processing. By understanding the unique requirements of high-risk industries and working with the right payment processor, businesses can minimize risks, improve transaction security, and stay compliant with regulations.

If you’re a high-risk merchant looking for a reliable payment processing solution, consider partnering with Cathedral Payments, where our expertise in high-risk industries ensures that your business can grow securely and thrive in the digital economy.