To streamline high-risk payments gateways, almost all businesses use a merchant account. This sort of account specializes in streamlining payments with the least chances of chargebacks, fraud, or regulatory issues. An approved merchant account in 2025 could be the difference between successfully processing payments and facing frustrating roadblocks.

One challenge that high risk businesses face is obtaining approval for their merchant accounts. These accounts are subject to extra scrutiny and restrictions due to their high-risk nature. Understanding how to get approval quickly can make a major difference in your growth and profitability. Keeping everything in view, we have compiled a comprehensive guide to help you obtain approval quickly. Let’s take a closer look at it.

Why is Getting Approved for High-Risk Payments Through a Merchant Account Challenging?

High-risk payment processing carries inherent financial risks for providers. Chargebacks and fraud are more common in these industries, so payment processors often impose stricter controls. Some of the other challenges include.

- Higher fees to offset risk

- Rolling reserves to hold a portion of funds temporarily

- Processing limits on transaction volume or amounts

- Stricter KYC underwriting (Know Your Customer) and verification

These extra steps aim to protect both the payment processor and the merchant from losses. That said, the process doesn’t have to be overwhelming if you understand what’s required and prepare accordingly.

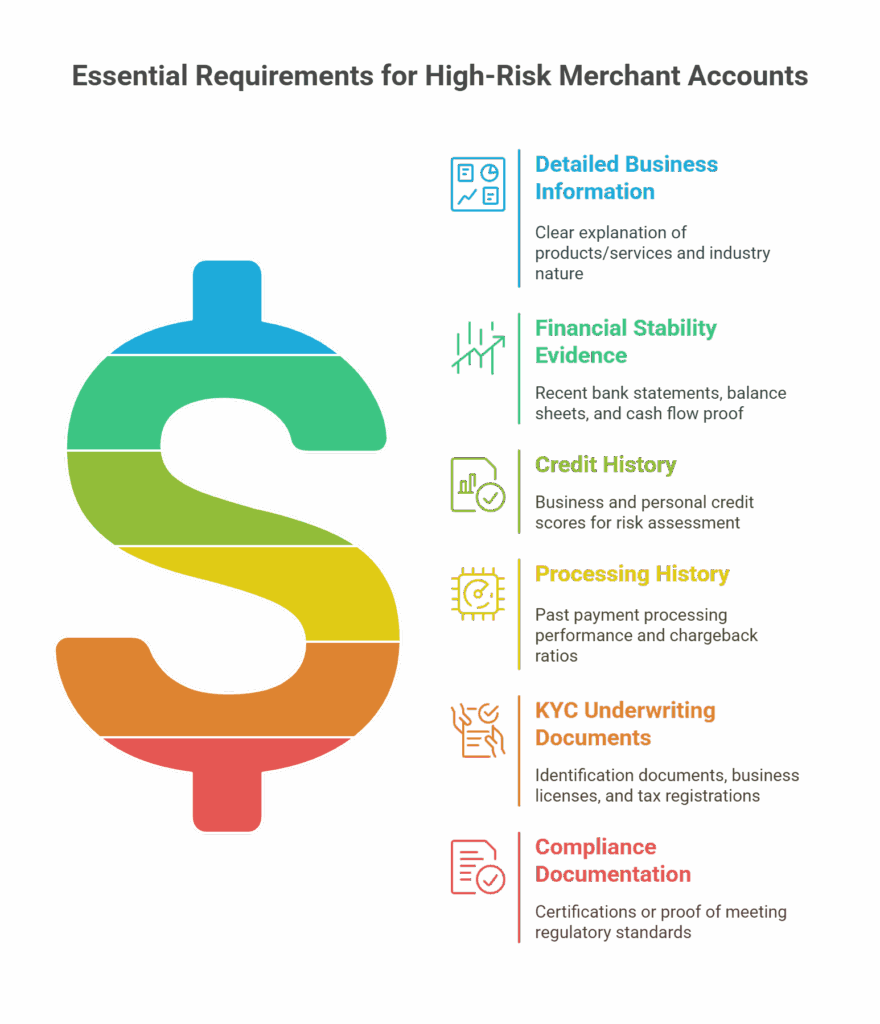

Key Application Requirements for High-Risk Merchant Accounts

To get a High-risk merchant account approval, you need to provide certain information to your provider. Providers typically look for the following.

- Detailed Business Information: You need to provide a clear explanation of your products or services and the nature of your industry.

- Financial Stability Evidence: Make sure to present your recent bank statements, balance sheets, and proof of cash flow.

- Credit History: Your business and personal credit scores are used to assess risk.

- Processing History: If applicable, details of past payment processing performance and chargeback ratios.

- KYC Underwriting Documents: Identification documents, business licenses, and tax registrations to verify your business’s legitimacy.

- Compliance Documentation: Certifications or proof that your business meets relevant regulatory standards.

Having this information ready and accurate can speed up your application and minimize back-and-forth questions.

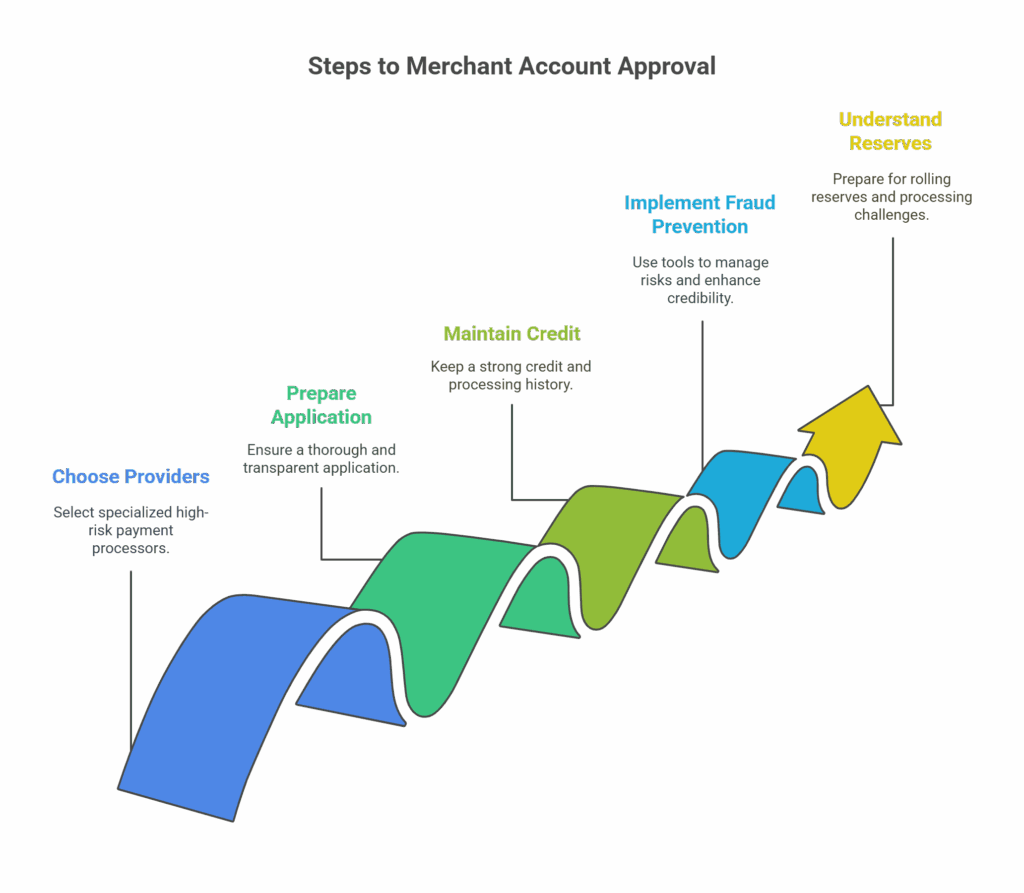

Steps to Improve Your High-Risk Merchant Account Approval Odds

Securing a high-risk merchant account involves several steps. Understanding these steps will help you perfect your application, which will reduce the rejection chances to nil. Here are a few simple steps to obtain an approved merchant account.

Choose Providers Specialized in High-Risk Industries

Not all payment processors are comfortable working with high-risk businesses. Providers specializing in high-risk payment processing have a better understanding of the unique challenges. They are more likely to offer the easiest high-risk merchant account to get approved for.

These providers usually offer:

- Customized application processes

- Flexible processing limits suited to your business size

- Better terms for rolling reserve release schedules

- Faster same-day approval for qualified applicants

Find such payment processing providers with a proven track record in your industry for a smoother experience. These providers will assist you with the processing of your merchant account, providing professional advice to help you streamline payments without any hassle.

Prepare a Thorough and Transparent Application

Accurate, detailed, and transparent application materials can build trust with underwriting teams. Clearly explain your business model, sales channels, and risk management practices.

Include documentation that supports your claims about revenue, chargeback prevention, and compliance. Errors or missing information can slow approval or result in rejection.

Maintain a Positive Credit and Processing History

Creditworthiness continues to play an important role in high-risk merchant account approval. A strong credit score and clean processing history signal stability.

If you’re a new business without a processing track record, showing strong personal credit and a solid business plan can help offset this gap.

Implement Strong Fraud Prevention Practices

Payment processors value merchants who actively manage risks. Use tools like address verification systems (AVS), CVV checks, and real-time transaction monitoring. Demonstrating these safeguards within your application can enhance your credibility.

If you have implemented these security measures, you can get same-day approval from your processor. This is the primary factor that accelerates your approval process.

Be Ready for Rolling Reserves and Processing Challenges

Many high-risk merchant accounts include rolling reserves. It is a percentage of your sales held back temporarily to cover potential chargebacks. Understand these terms and prepare your cash flow accordingly.

Your merchant account’s processing limits may also apply, setting a cap on transaction volume or amount. Knowing these in advance helps you plan growth and negotiations with your provider.

High-risk accounts often face increased regulatory scrutiny. Meeting all compliance requirements and maintaining high security standards protects your business and customers. Use encryption protocols for data protection and keep all licenses and certifications up to date. Providers will appreciate your diligence during periodic reviews.

What to Expect After Approval

Once approved, your high-risk payment processing provider may implement risk management tools, such as real-time fraud detection and chargeback prevention. You may also receive.

- Access to specialized dashboards for transaction monitoring

- Assistance with rolling reserve release scheduling

- Dedicated customer support for high-risk payment concerns

Being proactive in communicating with your provider post-approval can improve your long-term relationship and reduce interruptions.

Final Thoughts

In 2025, an approved merchant account can give you an extra edge to optimize your business operations. For high-risk payments, these merchant accounts can promise you a platform with the lowest chances of fraud and chargeback ratios. Having a reliable provider by your side will offer flexible and transparent terms. With the right approach, 2025 can be the year your high-risk business gains reliable payment processing that supports growth and stability.

In this complex journey of account approval, Cathedral Payments can be a name you can rely on. We have a straightforward method with minimal documentation, allowing you to obtain approval for your high-risk merchant account in just a few days. We also offer same-day approval to businesses, streamlining their payment process smoothly.

Contact Cathedral Payments today to start processing with confidence!