Individuals involved in high-risk businesses consistently seek practical solutions to ensure a smooth cash flow and operational efficiency. The search includes opening an account that works perfectly in high-risk payments with effective processing solutions. One account that helps businesses navigate the complex world of payment acceptance is a merchant account.

Enterprises operating in high-risk industries, such as gambling, cryptocurrency, or the adult industry, can benefit from a high-risk merchant account. It will help them streamline their payments in the fastest way possible. How does it do it? Let’s take a closer look at it.

What is a High-Risk Merchant Account?

A merchant account is a type of high-risk payment processing account designed for businesses that have higher chances of experiencing chargebacks, fraud, or regulatory scrutiny. These enterprises operate in industries where payment processors seem risky due to subscription-based models, high transaction volumes, or other attributes that could lead to financial instability.

Businesses categorized as high risk may face stricter requirements, such as higher processing fees, rolling reserve, and better fraud prevention measures. While opening and operating a high-risk merchant account can be more challenging, it ensures that businesses can still accept payments securely and efficiently.

How Does a High-Risk Merchant Account Work?

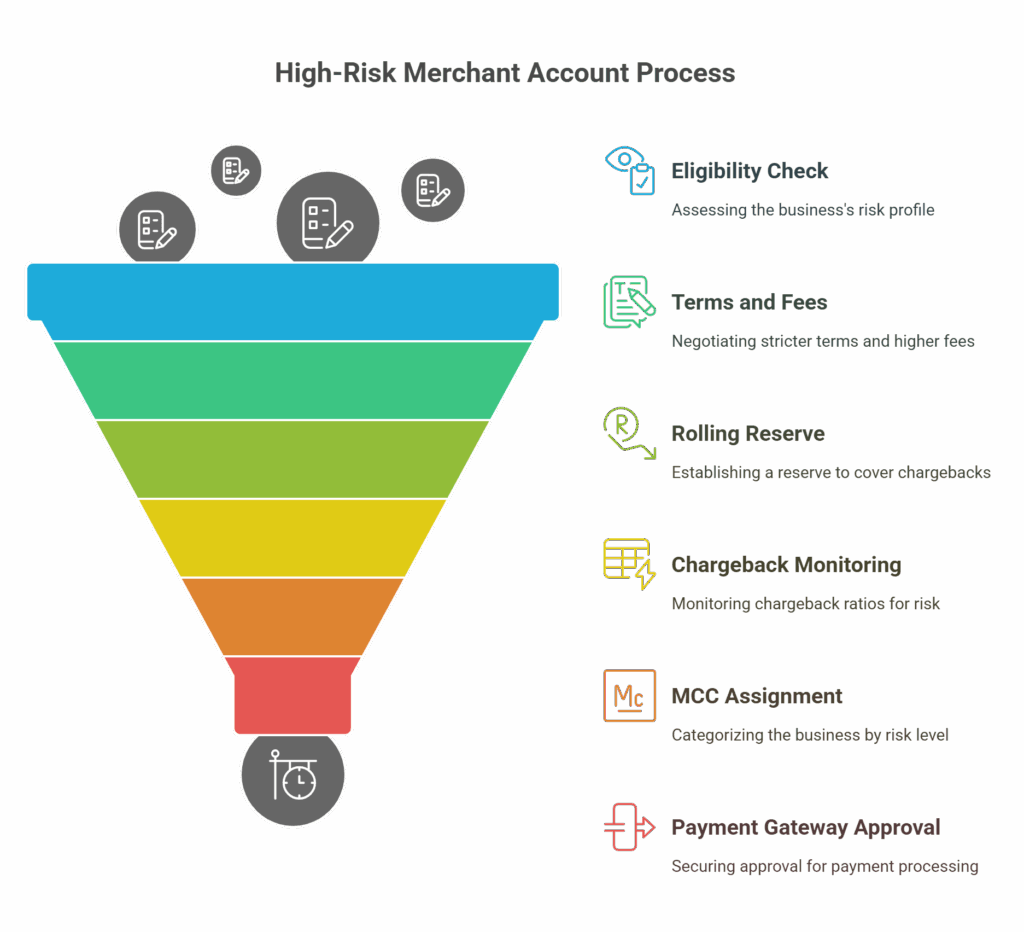

High-risk merchant accounts operate differently from standard merchant accounts due to the increased risk involved. They come with stricter terms and conditions, including higher fees and added safeguards for the payment provider. Below are key aspects of how these accounts function:

Eligibility

Not all businesses are eligible for a high-risk merchant account. Often, businesses needing such an account have difficulty finding a reliable payment processor that will work with them due to their perceived risk.

However, some payment processors specialize in offering high-risk merchant services, allowing these businesses to process payments. These specialized processors are well-versed in handling higher-risk businesses and are equipped to support the additional complexities that these businesses present.

Stricter Terms and Higher Fees

High-risk payment processing accounts typically come with higher fees than standard merchant accounts. Payment providers impose these fees to offset the risk they take on when dealing with businesses that may have a higher chargeback or potential fraud rate.

Additionally, businesses with high-risk merchant accounts often have to comply with stricter requirements and conditions to maintain their account.

Rolling Reserve

One of the significant features of a high-risk merchant account is the “rolling reserve.” It is a portion of the funds from a merchant’s transactions that the payment processor holds to cover potential chargebacks.

This amount is typically held in an escrow account for a specified period, usually ranging from 30 to 180 days. It is gradually released over time as long as the merchant maintains a good payment history. This helps payment processors mitigate the financial risks associated with chargebacks, fraud, and other payment-related issues.

Chargeback Ratio

Chargebacks are a critical consideration in the high-risk payment processing landscape. A chargeback occurs when a user disputes a transaction, and the payment provider refunds the money to them. Businesses with high chargeback ratios are often considered high-risk because chargebacks can incur additional fees and financial losses for the payment provider.

Merchants in high-risk industries or with poor chargeback histories may find their accounts subject to closer scrutiny or even termination if their chargeback ratio remains high.

Merchant Category Code (MCC)

Payment processors assign each high-risk business a Merchant Category Code (MCC). This code categorizes businesses based on their industry and the type of services or products they offer.

Some MCCs, such as those associated with gambling, adult entertainment, and telemarketing, are deemed high-risk. Businesses with such MCCs will almost certainly be classified as high-risk and may face more stringent requirements for payment processing approval.

Payment Gateway Approval

In the U.S., obtaining payment gateway approval for a merchant account can be challenging. Payment gateways are a modern technology that allows businesses to accept payments online or via credit card terminals.

For companies that fall into the high-risk category, obtaining a U.S. payment gateway approval can be more difficult due to concerns about potential chargebacks, fraud, and regulatory issues. Specialized payment processors may be required to handle these high-risk businesses, which have the necessary infrastructure and experience to manage the added risks.

Longer Settlement Periods

High-risk merchants often face longer settlement periods. In other words, it can take longer for the funds from their transactions to be transferred into their bank account. This delay is due to the higher likelihood of chargebacks and fraud claims.

Therefore, payment processors must ensure that any potential disputes are resolved before releasing the funds. Businesses should plan accordingly, understanding that cash flow may be impacted by these longer waiting periods.

Is Your Business Approved for a High-Risk Processing Account?

To be fully approved for a high-risk merchant account, businesses generally need to meet specific requirements set by the payment processor. These requirements may include providing.

- Detailed financial records,

- Implementing fraud prevention tools,

- And maintaining a low chargeback ratio.

Businesses that can demonstrate a stable payment history, good security measures, and proactive steps to reduce risks may increase their chances of being accepted for a high-risk merchant account.

Final Thoughts

For businesses seeking to streamline high-risk payments, a merchant account has emerged as a savior. Despite these accounts coming with multiple restrictions, such as higher fees or extra protections, this account allows you to ensure smooth operations without fear of fraud. So, if you are running or planning to start a high-risk business, a merchant account is a perfect solution for it.

Cathedral Payments has been committed to maximizing your payment processing efficiency in the long term. We provide high-risk payment processing solutions, including point-of-sale (POS) systems and hardware integration, tailored to meet your business needs. Get started with payment processing that’s fast, secure, and reliable. Reach out to an account specialist at Cathedral Payments today for a free rate quote.