Cathedral Payments is built on strong technical foundations. We take security seriously, incorporating advanced methods to protect sensitive customer data at every step. All our solutions comply with PCI DSS (Payment Card Industry Data Security Standard), which means that Cathedral Payments handles credit card transactions with strict security controls. Add to that modern SSL/TLS encryption protocols, tokenization, and multi-factor authentication, and you’ve got a platform designed to minimize fraud while maximizing trust.

This kind of infrastructure matters not only to large enterprises but also to smaller operations that depend on safer payment processing without the need for a full in-house IT department.

Key Takeaways:

- Cathedral Payments offers fast setup, transparent pricing, and reliable processing with no hidden fees.

- It supports secure cryptocurrency payments, helps reduce chargebacks with smart fraud tools, and provides 24/7 expert support.

- Few platforms match its blend of security, flexibility, and responsiveness.

How Cathedral’s Global Payment Solutions Stacks Up Against Competitors

One of the main challenges small businesses face when choosing a payment processor is uncertainty about fees compared to their competitors. We remove that concern by offering transparent pricing models. There are no surprise charges or hidden rates, just clear, upfront information that helps you plan better.

Speed also matters. Cathedral Payments provides a fast setup, allowing businesses to begin accepting payments quickly. This agility can make all the difference for startups or seasonal companies when launching a campaign or preparing for a sales peak.

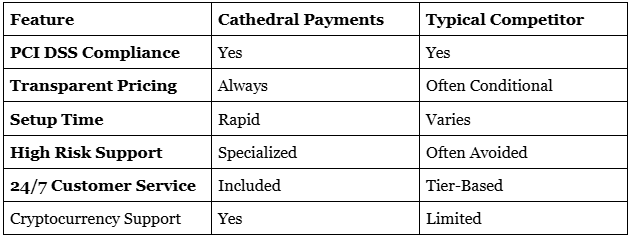

Compared to other online payment solutions, Cathedral Payments holds its own in several important areas:

Many processors either avoid working with high-risk businesses entirely or charge inflated fees. On the other hand, we offer tailored high risk payment solutions designed to support industries with more complex risk profiles. It also provides a reliable high risk payment gateway, allowing businesses in sectors such as supplements, gaming, and adult content to accept payments confidently.

Additionally, our team supports cryptocurrency payment solutions, giving modern businesses a way to accept Bitcoin and other digital currencies through a secure and stable system. This flexibility is essential for companies looking to remain competitive in a rapidly changing economy.

Chargeback Reduction for Business Owners

Chargebacks and disputes are more than a hassle; they cost businesses time and revenue. Cathedral Payments includes tools and strategies designed to reduce chargebacks by flagging suspicious activity early, authenticating transactions more securely, and giving merchants clear records to defend against illegitimate claims.

This proactive approach can mean fewer revenue disruptions and a smoother experience for your customers. Whether you’re in retail, SaaS, or subscription services, fewer disputes mean fewer complications.

Industry Recognition & Best-In-Class Certifications

We have earned recognition for our strong track record in providing secure payment processing. It meets global security standards and is regularly audited for compliance and performance. While many companies boast certifications, Cathedral backs them up with consistent performance and industry trust.

Its standing among the Best payment processing for small business is reinforced by its accessibility, pricing clarity, and responsive support. These aspects are all crucial for companies that can’t afford to wait on hold when issues arise.

Always-On Support that Actually Helps

A payment platform is only as helpful as its support team. We provide 24/7 customer service with real humans, no frustrating loops of automated messages or unanswered tickets. Whether you’re trying to set up a new integration, address a transaction issue, or get advice on payment gateway configuration, help is available when you need it.

Customer service is often overlooked in the payment space, but it makes a measurable impact on business operations. Cathedral’s team focuses on quick responses, technical knowledge, and client satisfaction.

A Smart Option for High-Risk Industries

Many business owners find it challenging to find reliable high risk payment processing. Whether you operate in CBD, gaming, forex, or other regulated sectors, Cathedral Payments works with you to find practical solutions. Instead of turning businesses away, we build gateways and processing tools around your needs, offering flexibility and compliance at once.

These businesses often face higher chargeback rates and scrutiny from banks, which makes Cathedral’s risk management and fraud protection tools especially valuable. From AI-driven transaction monitoring to secure API access for developers, our payment solutions adapt to high-risk needs without overcomplicating the process.

Built-In Cryptocurrency Payment Options

As more consumers seek to pay with digital currencies, offering cryptocurrency payment processing becomes more important. Cathedral Payments makes it easy for businesses to integrate crypto into their checkout process, with real-time conversions, low transaction fees, and advanced security.

This feature is a revenue opportunity for companies that want to expand their reach to global or privacy-focused consumers. And unlike some providers that outsource this function, our team manages the process directly for higher reliability.

Conclusion

Cathedral Payments is a solution built with real business needs in mind. It combines top-tier Global Payment Solutions with practical features like transparent pricing, high-risk support, and crypto compatibility. We offer reliability and flexibility for companies searching for the best payment processing for SMEs without the inflated price tags or support delays common elsewhere.

If you’re ready to switch to a platform that values your security, respects your time, and treats you like a partner, Cathedral Payments is worth considering.