When it comes to processing payments for businesses, not all industries are treated equally. While some businesses may have no trouble finding a payment processor, others—especially those in high-risk sectors—struggle to secure the services they need to thrive. But what is high-risk payment processing, and why do traditional payment processors like PayPal, Stripe, and Visa shy away from high-risk merchants? In this article, we will explore the reasons behind this reluctance and provide strategies to overcome these challenges.

What Makes a Merchant “High-Risk”?

Before diving into why traditional processors avoid high-risk merchants, it’s important to understand what makes a merchant high-risk. A business is typically considered high-risk if it falls into one or more of the following categories:

- Frequent Chargebacks: A chargeback is a request made by a customer to reverse a payment. High-risk industries often have a higher chargeback ratio, which is a major concern for processors.

- Regulatory Scrutiny: Industries like CBD, adult entertainment, and gambling face strict regulations, making them difficult to process payments for through traditional channels.

- Unpredictable Revenue: Businesses with fluctuating or high transaction volumes, such as subscription-based services, pose a risk due to the unpredictability of sales.

- Fraudulent Transactions: Sectors like online gambling and telemarketing often deal with higher rates of fraud, making them unattractive to traditional payment processors.

Why Do Traditional Payment Processors Avoid High-Risk Merchants?

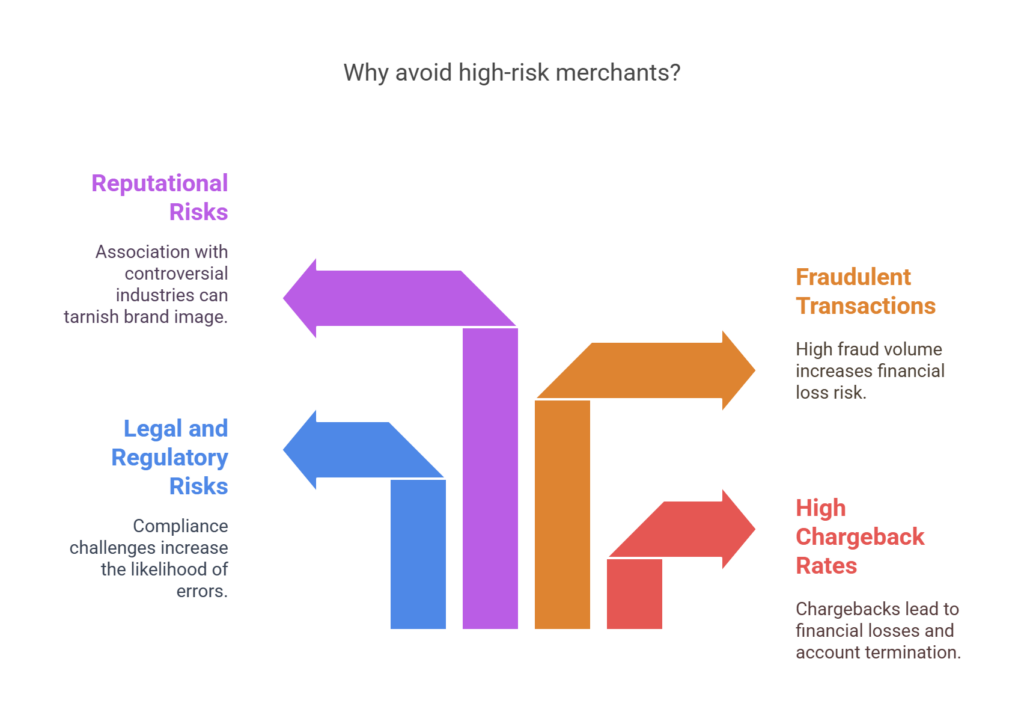

High Chargeback Rates

Chargebacks are one of the biggest reasons traditional payment processors avoid high-risk businesses. When a customer disputes a transaction, a chargeback occurs, which can result in financial losses for both the merchant and the processor.

Traditional payment processors, like PayPal and Visa, often impose strict policies on chargeback ratios. Merchants with high chargeback ratios are considered too risky for these platforms, and if the ratio exceeds a certain threshold, the business may have its account frozen or terminated.

Legal and Regulatory Risks

High-risk industries such as CBD, online gambling, and adult entertainment face a labyrinth of legal and regulatory hurdles. Each of these sectors is governed by unique rules, making it difficult for traditional processors to keep up with compliance.

For example, the CBD industry faces challenges due to varying laws across different states in the U.S. This complexity increases the likelihood of errors and non-compliance, making it more difficult for payment processors to confidently work with these businesses.

Fraudulent Transactions and High-risk Behavior

Certain high-risk industries attract fraudulent activity. Online gambling platforms, telemarketing, and digital goods sellers often experience a higher volume of fraud, which is another key factor in a payment processor’s decision to avoid these businesses.

In addition, businesses in high-risk sectors may operate in markets with a significant amount of transaction disputes. Fraudulent chargebacks, combined with high-risk customer behavior, increases the likelihood of a financial loss for the payment processor.

Reputational Risks

Traditional payment processors are highly concerned with their brand reputation. Partnering with high-risk merchants, especially those in controversial industries, can tarnish their reputation and lead to negative press.

For instance, if a payment processor were to be associated with illegal activities or industries considered unethical, it could hurt their standing with regulators, customers, and investors.

How High-Risk Merchants Can Overcome These Challenges

Although traditional payment processors are often hesitant to work with high-risk businesses, there are ways for merchants to secure reliable payment processing solutions.

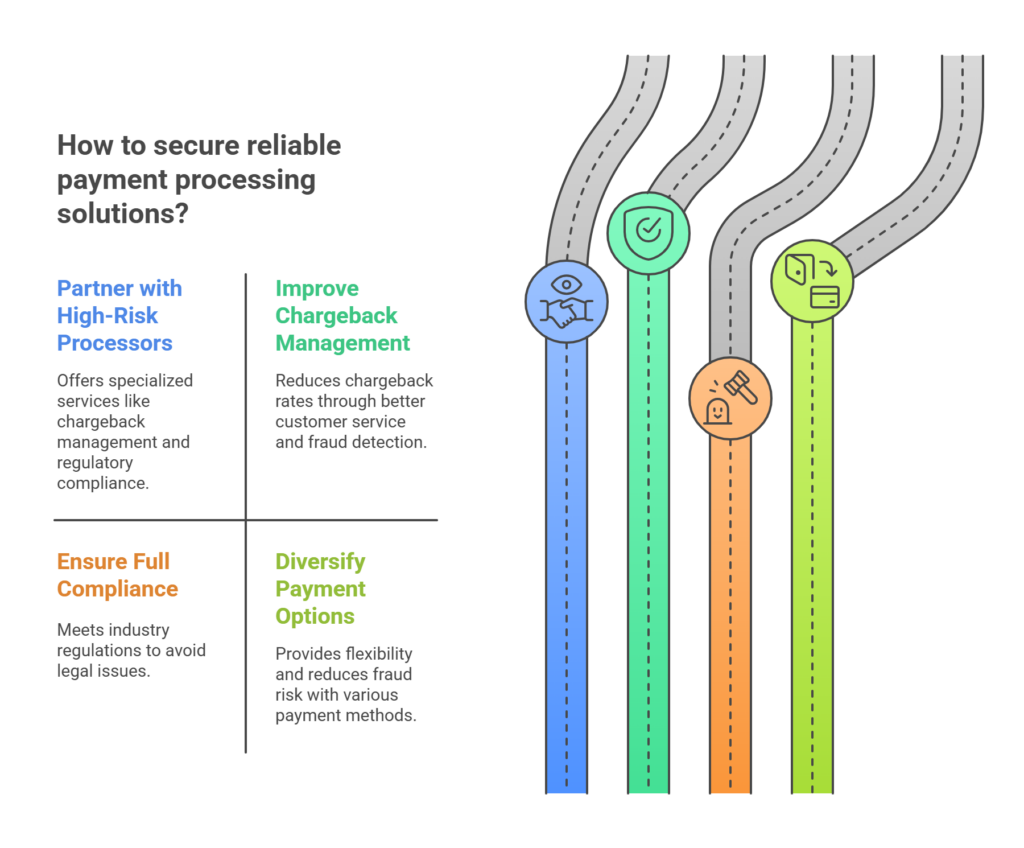

Partner with High-Risk Payment Processors

The first step for high-risk merchants is to work with specialized high-risk payment processors. Unlike traditional processors, these companies are experienced in dealing with high-risk sectors. Cathedral Payments, for example, is a leader in high-risk payment processing and provides tailored solutions for businesses in industries like CBD, adult entertainment, and gambling.

These specialized processors offer several benefits, such as:

- Chargeback management and fraud detection tools.

- Regulatory compliance assistance to help navigate complex laws.

- Flexible payment processing options, including ACH payments, credit card processing, and eCheck solutions.

Improve Chargeback Management

One of the best ways to overcome high chargeback rates is to focus on chargeback mitigation. This can be achieved through:

- Offering superior customer service to address customer concerns before they escalate into chargebacks.

- Providing clear product descriptions and transparent billing processes to avoid confusion.

- Using fraud detection tools to identify and block fraudulent transactions before they occur.

By improving chargeback management and keeping chargeback ratios low, high-risk merchants can become more attractive to payment processors, even those with higher standards.

Ensure Full Compliance

High-risk merchants must stay up-to-date with their industry’s regulations and compliance standards. Whether it’s adhering to the laws governing CBD or following the regulations for gambling transactions, remaining compliant is crucial for success in these high-risk sectors.

Working with a payment processor that provides compliance resources, such as PCI-DSS compliance, AML (Anti-Money Laundering) procedures, and KYC (Know Your Customer) checks, can help ensure that your business meets all necessary requirements.

Diversify Payment Options

Traditional processors often offer limited payment methods for high-risk businesses. By working with specialized processors, businesses can diversify their payment options. For example, merchants can accept ACH payments, which are often more reliable than credit card payments for high-risk businesses.

Additionally, payment options like eChecks and digital wallets offer flexibility and may reduce the overall risk of fraud or chargebacks.

The Importance of Finding the Right Payment Processor for High-Risk Merchants

Choosing the right payment processor is one of the most crucial decisions a high-risk merchant can make. A payment processor that specializes in high-risk industries will understand the unique challenges businesses face and will offer solutions tailored to their needs.

Conclusion:

High-risk payment processing can be daunting, especially when traditional payment processors are reluctant to work with businesses in sectors like CBD, gambling, and adult entertainment. However, by partnering with specialized payment processors, focusing on chargeback mitigation, ensuring compliance, and diversifying payment options, high-risk merchants can successfully navigate these challenges.

If your business operates in a high-risk sector, it’s important to find a reliable partner like Cathedral Payments to help you thrive in a competitive and sometimes difficult environment. With the right tools, support, and solutions, high-risk businesses can continue to grow and succeed while minimizing the risks associated with payment processing.